Ocean Trader - Game 01 - Professional runthrough

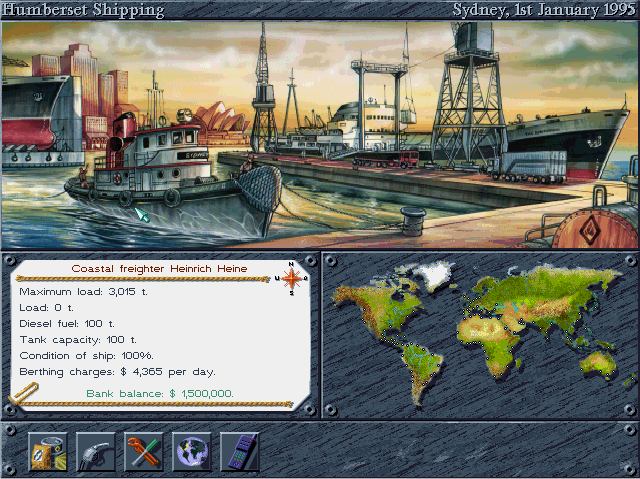

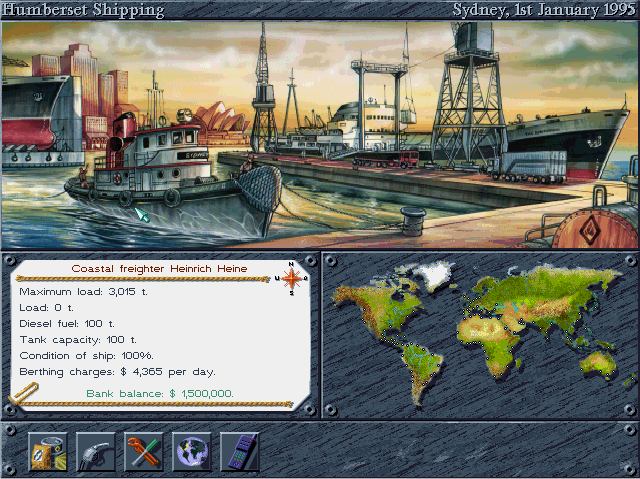

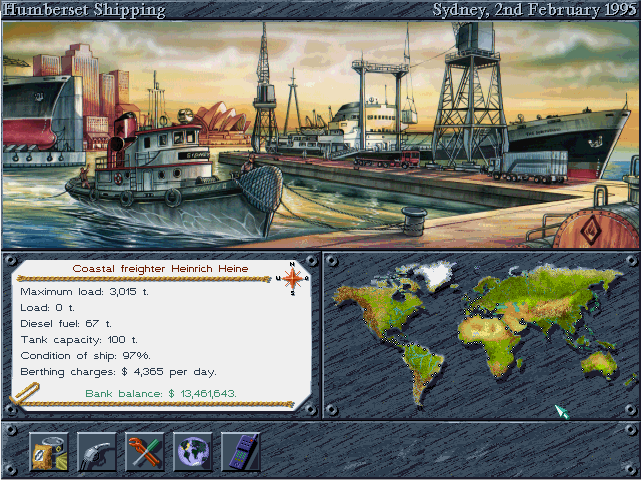

We start of with the coastal freighter Henrich Heine in perfect condition. Either brand new or just repaired. Buying a new ship of this type would cost $10.000.000, though it is worth $8.000.000 if we attempt to sell it. In addition we have $1.500.000 cash in reserve to carry expenses and buying cargo to move. We thus count the start as if we had $11.500.000 to invest, and chose to invest in a coastal freighter. The low cash reserve will make it hard for us to cut a decent profit. My calculations estimate that from this position we'd get around $65.000 daily average income the first year. However, to begin with we'll need to haul cheap cargo and get to where we can carry cheap cargo with decent profit, so the first trip will not give us much at all. The optimal trip seems to go to Algiers, where profit will pick up. Lets check the bank.

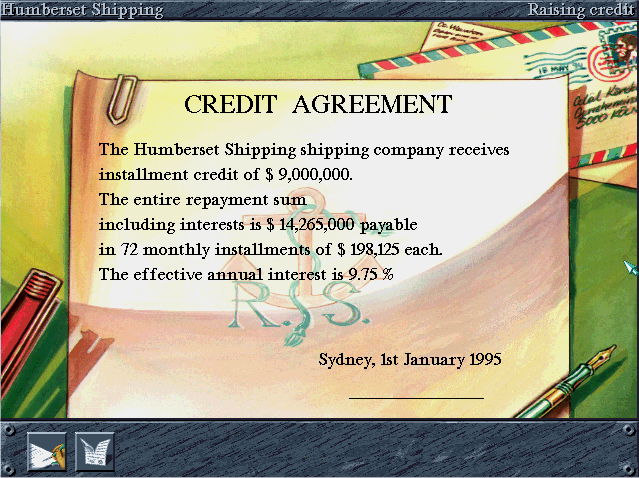

We can loan $9.000.000 with a measily 9.75% interest. Awesome. That will only cost us $5.265.000 in the span of 6 years. Why 9 million? If I try to sell our ship I'm offered $8 for it, so together with the cash, that's $9.500.000 assets in our company. Sounds like we're able to loan almost what we're worth, doubling our assets to work with for now. That gives us a totally different plain for hauling cargo initially. Machines to Melbourne should give us a more than $100.000 daily profit.

Within the 6 year loan period, there will be 72 monthly payments at the end of each month. That means the loan isn't technically for 6 years, but 6 years minus the days already spent this month. Given that the period includes 2 leapyears (does the game account for those), the period here will be a total of 2191 days, making the $5.265.000 cost $2403 per day.

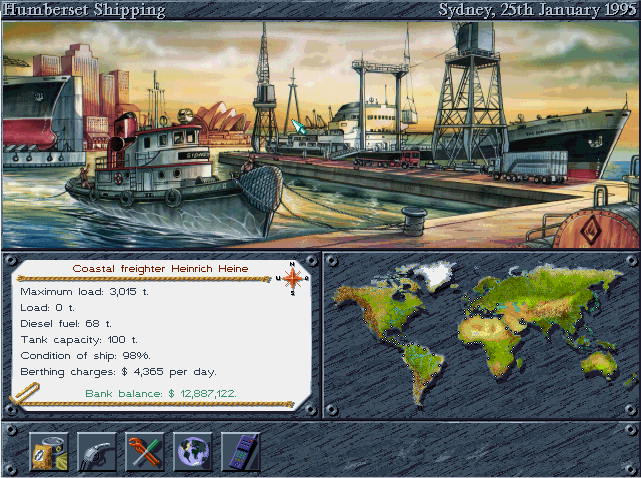

To begin with we've been trading Cars, Machines and a few tons Sugar to Melbourne and carrying Chemicals back. That's a pretty decent route, so in the first 24 days here we've made $2.387.122, which is a $97.062 daily profit adjusting for loan expenses. Additionally we've used some fuel we haven't bought back, and worn the ship 2% so we need to repair that at some time, but I don't think those costs will reduce the daily profit that much. Grabbing a few Machine/Chemical runs to Melbourne more before going further.

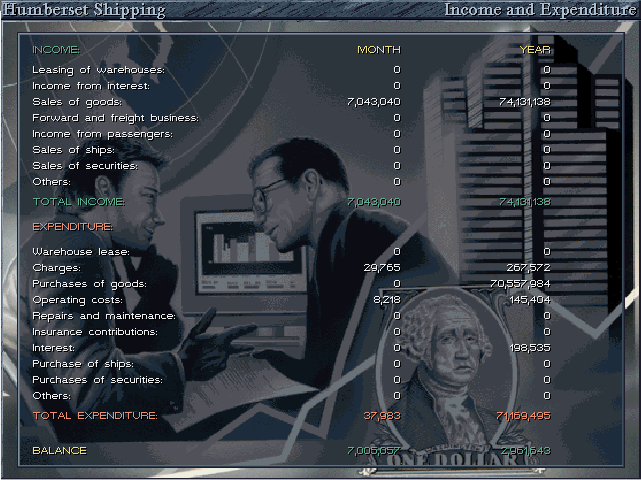

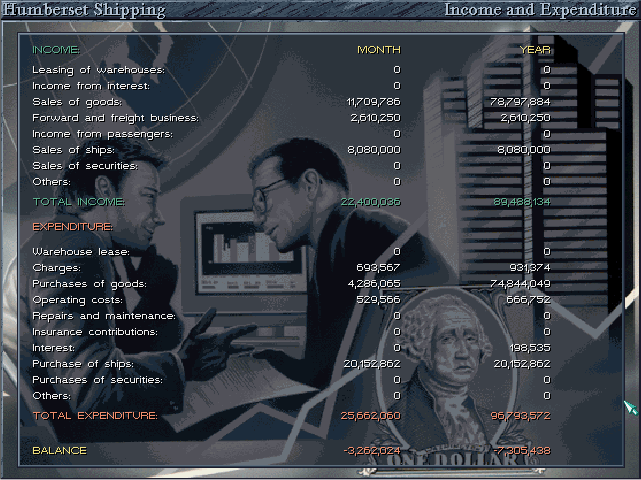

1995.02.02: Back at Sydney with Chemicals. After selling we're now at $13.461.643. A month has passed. Lets look at the financial numbers.

We'll create our own bank statement too, as the in game one is misleading. As we want to calculate how much profit we've managed to make in comparison to our investment, we'll count up until this trip, to make it easier to calculate everything, and then rather modify our numbers to fit the number of days we are counting.

| Income: | |

| Sales of goods: | 74.131.138 |

| Expenses: | |

| Purchase of goods: | 70.557.984 |

| Port charges, berthing costs: | 267.572 |

| Operating costs (incl. fuel): | 150.090 |

| Interest loan: | 76.896 |

| Ship wear | ? |

| Result: | |

| 3.078.596 | |

| Daily profit: | |

| 96.206 | |

We expected a loan downpayment of $198.125, where $125.000 of it was just paying back money we loaned, and the rest was interest. The in game statement for bills us a bit more, $198.535, and puts both the interest and the payback part as expenditure. As you may pay for fuel, even if you're out of money, and with operations costs running while you're already below zero, the gap of $410 likely is interest of money lended due to going into negative balance before selling goods at target port.

The operating costs have been modified to include the $142 x33 cost of filling up our fuel tank, as we started the period with a full tank.

The cost of ship wear is unknown. Repairing costs both money and time, and we should account for that part. We'll get back to that. The actual profit will be a bit less than the above due to this, as we currently ignore this fact.

Ignoring ship wear, our profit was almost 26% of our invested $11.500.000 this single month.

Going forwards, investors will hope to keep a high profit of investment each month, but that is not likely to happen unless we ramp up. Once we have enough spare cash to buy the goods we need for the most profitable routes, further cash reserve will need to be invested somewhere else for that part to also grow. The natural growth would be to acquire a new ship, and then the question is, what ship to buy at what time. Should we buy another Coastal Freighter as soon as we can, or save up longer to get a bigger ship? In any case, we'll have some money surplus in the time period before we've saved up for a new ship, can we leverage that in some way? Some alternatives:

Another coastal freighter costs only $10.000.000 and we can afford it right now. It "only" takes 4 months to build. Loaning another $3.000.000 from the bank, we'll have $6.500.000 cash reserves for wares now, and should earn enough to have money for wares for both ships in 4 months time. After 4 months we can likely double our income with the two ships.We could also save up to create a bigger ship, like a freighter or large freighter. However, they are much more expensive to buy and take longer to build. Looking at the timeline it takes to get enough money to buy one, it will be at least as fast to go for a coastal freighter first, as that will pay itself back prior to being able to buy a larger ship.

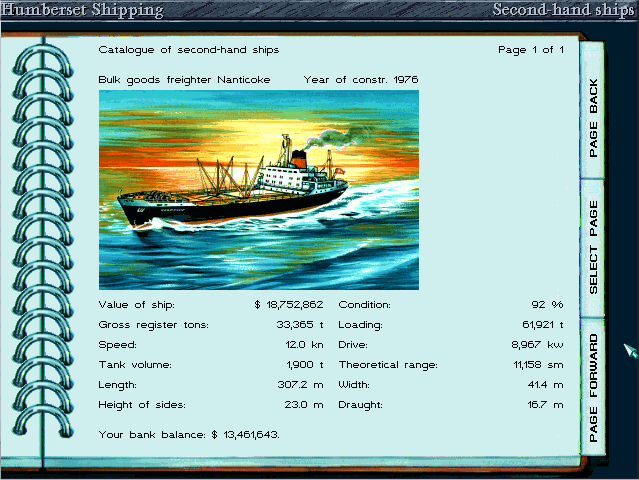

A better alternative is finding a used ship we can buy. There's two massive advantages for using a used ship. First you get it almost immediately, wasting little time with frozen assets, and secondly, it typically comes cheaper as it is used. You will need to repair it at some time, but you may be able to earn quite a bit of profit before that. A used ship will likely not have an optimal design, but the lower cost and cut waiting time should more than make up for it.

Each new month, the available used ships for sale change, and this month we have gotten a bulk goods freighter available that looks very promising. It is expensive for us at this time, but if we take up another $3.000.000 loan and sell our coastal freighter, we should be able to afford it. The price looks very good. A new sihp with equal stats would cost around 56 million dollars, and take 10 months to build. A bulk goods freighter is much more limited in what wares it can carry than our coastal freighter, but I think we should be able to manage. With this ship we should be able to boost our profits considerably.

Conclusion: As luck would have it we have a great used ship available, and that beats any ship we can build hands down. We'll buy it right away and get started making money.

As we've decided to switch ships and we need to sell our existing one to afford it, we cash in and can get a correct statement. We are offered $8.080.000 for our ship, losing almost two million in one month is harsh, but the new ship should make up for it. As the ship cost $10.000.000 initially, that means we've lost $1.920.000 in ship wear. Though, we can exclude the $4686 for filling up the fuel tank. That leaves only $1.163.282 in profit for the 32 days period tracked above, which is a daily profit of only $36.352. That figure isn't representable for what the profit of a single coastal freighter would be on average, but it still corresponds to a 115% increase in our assets within the first year if it would have continued like that. That leaves the company investment now at $12.663.282. Remaining money is from loans.

For unknown reasons, our credit rating goes down when we sell our ship and buy Nanticoke, so we take up another $3.000.000 loan from the bank first. Nanticoke is very expensive for us at this time, so we need all the dollars we can get our hands on to afford wares to ship later. The rent is still 9.75%, giving us 72 payments of $66.041, which will cost uis $1.754.952 in interest over the 6 years period.

Then we sell our ship for $8.080.000 taking a big loss of our initial investment, which we had no control over as it was decided by game start. That leaves us $24.541.643 banked. The price listed in the image is not correct for some reason. We're given an offer for $20.152.862 to buy the ship. They say it's an absurdly low sum and I agree. Selling our last ship, time starts ticking again, but the Nanticoke is available already february 3rd. Our current bank balance is now $4.286.261. We have thus payed $102.520 extra, which seems to be $91.086 for 1 day of berthing charges and $11.434 for one days operational cost. We used to pay $4109 in operational costs, but I guess they depend on what ships we have. Will be interesting to see what port charges will be now.

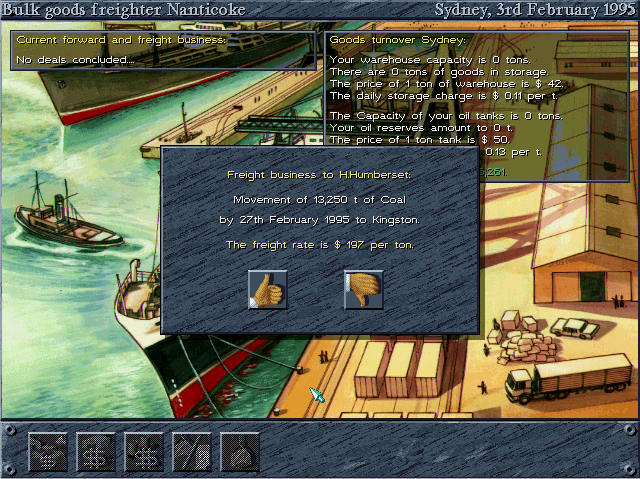

We get a contract offer in Sydney. It doesn't look that good, but as we're short on cash to buy cargo ourself, it's much more interesting just now. Also, there aren't any good bulk routes close to Sydney, so we likely want to get to the Americas anyhow, so this one looks worth it, if we can make it in time. At 12 kn it'll be close.

We make it in time, arriving february 24th, carring some more coal and a lot of ballast due to cash shortage. To our surprise, the sell price of coal is much lower than expected. $10 less per ton if I remember correctly. The AI shouldn't have been able to affect the marked that badly and goods available does not indicate the AI has ever sold this ware here this game. Is the contract for coal affecting coal price in the regular market? Or could price depend on what type of ship I'm using? We travel on to New Orleans with Sugar, and the price of Sugar is also considerable lower there than we expected. That makes it less likely that it was the contract that did it. Profit margins aren't what we hoped for.

|

|

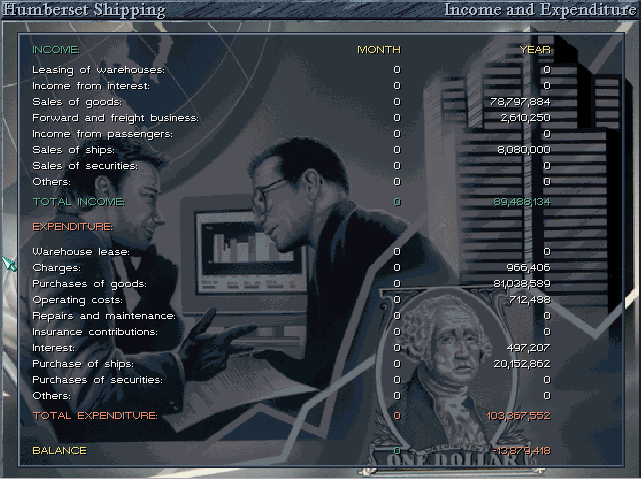

Month change come while we travel to New Orleans. Prior to buying goods in Kingston our bank balance is $6.194.562. After buying sugar we have $22 left. We grab the statement before departure prior to buying sugar, and the statement 28th of february, after the game has said month changed, but before day has switched to March 1st. We see that the operations cost have increased equal to 4x 11.434 which we found as the daily cost with this ship. We also notice the increase of interest. In addition to downpayments of our two loans, we have an extra $34.506 to pay. Likely interest of going below zero in bank balance. We were considerably below for many days, as we travelled far from Sydney to Kingston with negative balance and payed for Panama crossing to boot. Putting the entire cost of the ship as an expenditure this month is pretty silly. The ship is an investment. We also see charges have increased by Lastly, we see a difference in charges. It looks like we have payed Kingston's berthing costs x2 upon leaving.

20.867 20.877